Rehired Retirees

ERS Rehired Retiree Rates for Fiscal Year 2026

July 2025

The ERS rehired retiree employer cost rates for Fiscal Year 2026 went into effect on July 1, 2025, replacing the FY 2025 rates.

You will notice the effects of this change on the invoice dated September 1, 2025, which will reflect data reported for July 2025.

Important Updates for ERS Rehired Retiree Invoicing – Effective June, 2025

We would like to inform you about important changes to ERS Rehired Retiree invoicing that will take effect starting this month, June 2025.

Independent Contractors

When to report hours to the plan

Every year, ERSGA staff receives questions about rehired retirees and the 1,040 hours return-to-work provisions. One of the most frequent rehired retiree questions is in regard to independent contractors not on the payroll. Employers should know that few rehired retirees working as independent contractors are exempt from 1,040 hour reporting. The exemption to the 1,040 hour reporting requirement only applies to independent contractors who meet all of the following exceptions:

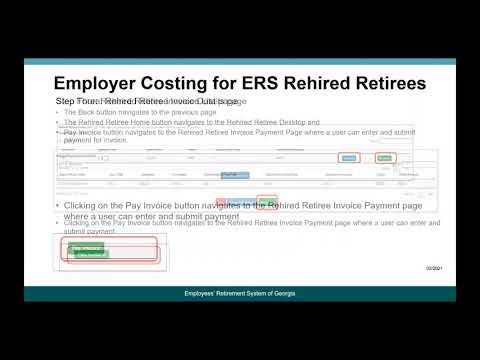

Employer Costing for ERS Rehired Retiree FAQ

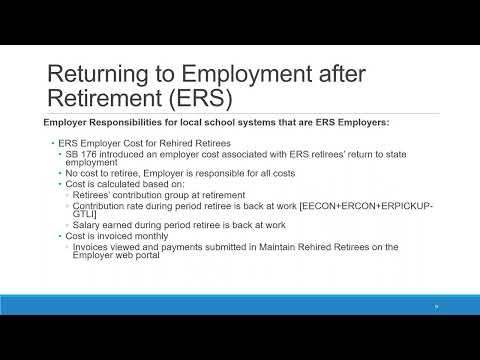

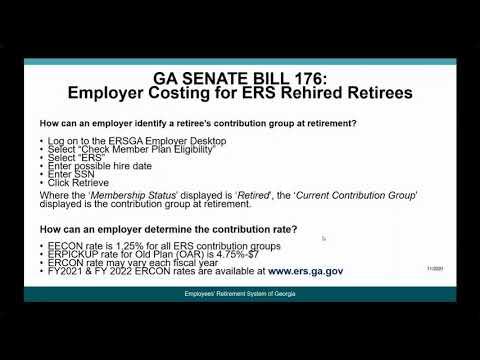

SB176 Employer Cost

11/2020

1. What are the employer costs dictated by SB176 based on?

GA Senate Bill 176 introduced an employer cost associated with ERS retirees’ return to state employment. The costs are based on the retirees’ contribution group at retirement and the contribution rate and salary earned during the period the retiree is back at work.

2. When are the employer costs for SB176 effective?

The employer costs introduced by SB176 are effective on and after 01/01/2021.

Rehired Retirees

Any employer (as defined in O.C.G.A § 47 2-1(17) and O.C.G.A § 47 2-112(a)) that employs a retired plan member must notify the Employees’ Retirement System of Georgia (ERSGA) in writing within 30 days of the employee’s acceptance of employment. If the retired plan member performs more than 1,040 hours in any calendar year, the employer must also notify the board of trustees as soon as such information is available. Any employer that fails to notify ERSGA as required must reimburse the retirement system for any overpaid pension benefits.